Welcome back to our blog series dedicated to the exhilarating world of startup pitching!

Following the success of our analysis of Season 1, we’re excited to dive into Season 2 of Shark Tank Egypt, where innovation and entrepreneurial spirit continue to thrive. This season has brought forth a fresh wave of startups eager to captivate the panel of investors with their groundbreaking ideas and business models.

In this Blog, we will dissect the pitches of the new cohort of entrepreneurs, examining their valuations, investment requests, and the outcomes of their funding endeavors. As we explore their journeys, we aim to provide valuable insights into what makes a pitch successful and the strategies that resonate with investors. Join us as we uncover the stories and lessons behind the 43 startups that participated in Season 2, illuminating the path for aspiring entrepreneurs in Egypt and beyond.

Season 1 and Season 2 of Shark Tank Egypt aired in January 2023 and October 2023, respectively, with a nine-month gap between the two seasons. Season 1 featured 43 startups, of which 25 (58%) received investment offers from the sharks. Among those, 21 accepted the offers, representing about 49% of all participants, while 4 declined. In contrast, Season 2 showcased 62 projects, reflecting a 45% increase in the number of startups. Out of these, 51 (82%) received investment offers, 9 projects from them chose to decline the offers. Building on our analysis of Season 1, our current focus on Season 2 aims to explore the evolving dynamics and trends in investor behavior and startup performance in this vibrant entrepreneurial landscape.

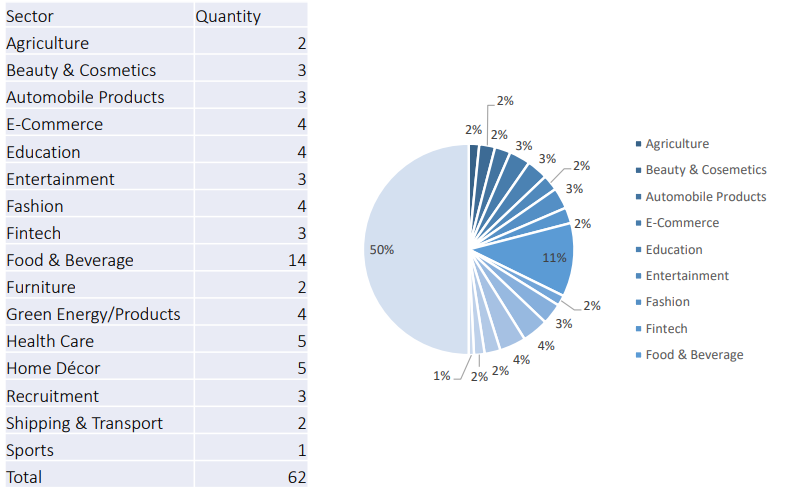

OFFERS RECEIVED ACROSS DIFFERENT SECTORS

The comparison between Seasons 1 and 2 of Shark Tank Egypt reveals significant shifts in sector representation. In Season 1, key sectors included E-Commerce (4), Food &

Beverage (3), and Education (3). In contrast, Season 2 saw a notable rise in the Food & Beverage sector, with 14 projects accounting for 21% of pitches, reflecting increased

consumer interest.

New sectors such as Beauty & Cosmetics, Entertainment, Fashion, and Furniture emerged, highlighting diversification in entrepreneurial ventures. While Education slightly increased to 4 projects, Fintech remained steady at 3 projects across both seasons. The consistent presence of Agriculture (2) and stability in E-Commerce (4) suggest a maturation of certain markets. A rise in Home Décor (5) & Health Care (5). Overall, Season 2 showcases a broader array of investment opportunities, adapting to changing

consumer trends and preferences in the Egyptian market.

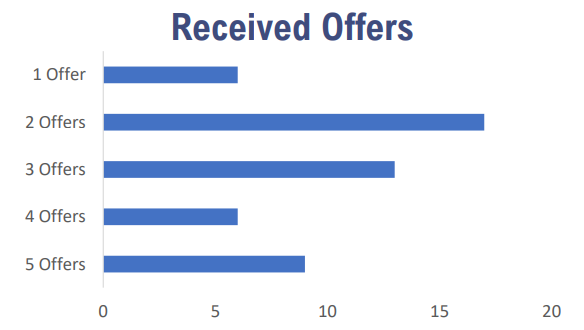

In Season 2, 17 businesses received two offers, accounting for 28% of the total 62 pitches, which indicates strong investor interest. Additionally, 13 projects secured three offers, representing about 21% of the total, highlighting a competitive appeal among the sharks. Remarkably, only 6 businesses received five offers, making up roughly 10% of the total pitches, showcasing exceptional enthusiasm for these ventures. This level of interest reflects the sharks’ confidence in the viability and potential of these projects, as receiving multiple offers often validates a startup’s credibility.

In comparing Shark Tank Egypt’s Seasons 1 and 2, notable trends emerge regarding investment offers. Season 1 featured 43 startups, with 25 (58%) receiving offers, including 14 that secured single offers. In contrast, Season 2 expanded to 62 startups, with 42 (68%) receiving offers, showcasing a higher overall interest from investors. However, while Season 1 had a significant number of startups receiving single offers, Season 2 saw none, as 17 startups attracted two offers, and 13 received three. Additionally, Season 2 highlighted a competitive edge with 6 startups receiving five offers, reflecting a shift toward more robust investor engagement and confidence in the evolving entrepreneurial landscape.

Overall, Season 2 demonstrated a higher level of competition among investors, with more startups attracting multiple offers compared to Season 1. This shift suggests an evolving landscape where investors are increasingly willing to invest in startups they believe in, reflecting growing confidence in the entrepreneurial ecosystem