As a Virtual CFO consulting company, we are dedicated to assisting startups in Egypt. We understand the importance of effective pitching in securing investment and driving business growth. Our blog series is where we delve into the thrilling world of startup pitching through an in-depth analysis of Shark Tank Egypt!

Shark Tank has become a symbol of entrepreneurial pursuit and investment opportunities. The program has provided a platform for aspiring entrepreneurs to showcase their innovative ideas and business ventures to a panel of investors. This blog series aims to dissect and analyze the pitches made by the 43 startups that participated in the first

season, shedding light on their valuations, investment ask, and funding outcomes.

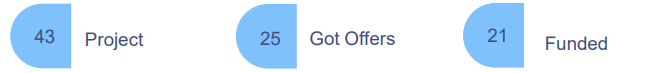

Of the 43 startups that pitched their projects in Season 1, 25, representing 58%, received investment offers from the sharks. Among those 25 startups, 21 accepted the offers, which accounts for 49% of the total startups. Four startups, however, decided to decline the investment offers.

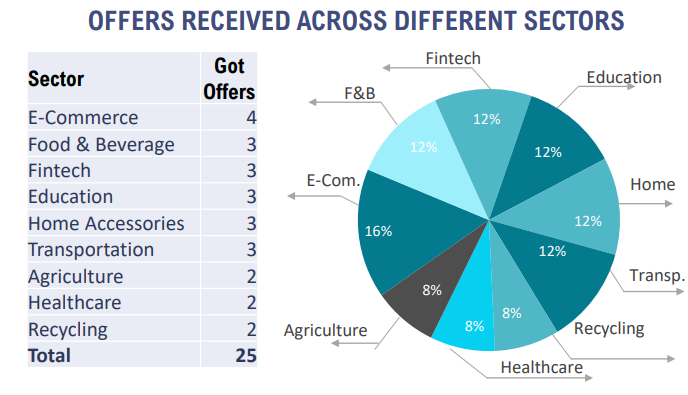

RECEIVED OFFERS

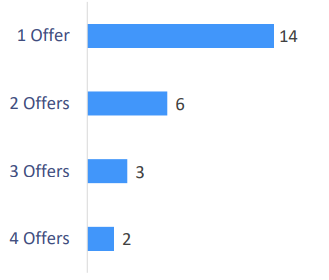

Out of the 25 startups that received investment offers, 14 of them, representing 56% of the total startups, received a single offer from one of the sharks. Six startups were fortunate to receive offers from two different sharks, while three startups received offers from three different sharks. Two exceptional startups were presented with a remarkable four investment offers from the sharks.

CASH ASK VS. CASH OFFERED

Through our analysis of the 25 startups that received offers, we discovered that the total cash amount requested by the founders was EGP 106 million. Interestingly, the total cash offered by the sharks surpassed this amount, reaching a total of EGP 110 million. This indicates that the sharks did not reduce the cash ask from the founders; instead, they offered more capital than what the founders had initially requested.

There could be several reasons why the sharks chose to offer the requested cash or even more without negotiation:

- Demonstrating Support: By offering the full cash amount or more, the sharks aim to demonstrate their support for the founders’ business plans and objectives. It signals their confidence in the startup’s potential and their willingness to provide the necessary financial resources to help the founders achieve their goals.

- Building a Positive Relationship: Offering the full cash amount without negotiation can help build a positive relationship between the sharks and the founders. It fosters trust, transparency, and a sense of partnership, which are vital for long-term collaboration and support.

- While the sharks may not negotiate on the cash ask, it’s important to note that other aspects of the investment deal, such as equity allocation and board representation, may still be subject to negotiation.